Romaldkirk Parish Council

Finance

There are strict regulations which the Parish Council must comply with to ensure accountability for its proper use of public money.

Each year the Council must produce an Annual Governance and Accountability Return and details of these can be accessed from the menu item.

Budget approved for 2025-2026

In January 2025 the Parish Council approved its budget for the financial year April 2025 to March 2026. Following the 2024/25 year end, the General Reserves figure was then adjusted to take into account the outturn from the 2024/25 year.

You can view and download the detail of the approved budget here.

The tax base for 2025/26 is 103.2, increased by 4.3 from 98.9 in 2024/25.

The Parish Council is once more to receive no grant from the Local Council Tax Reduction Scheme allocation.

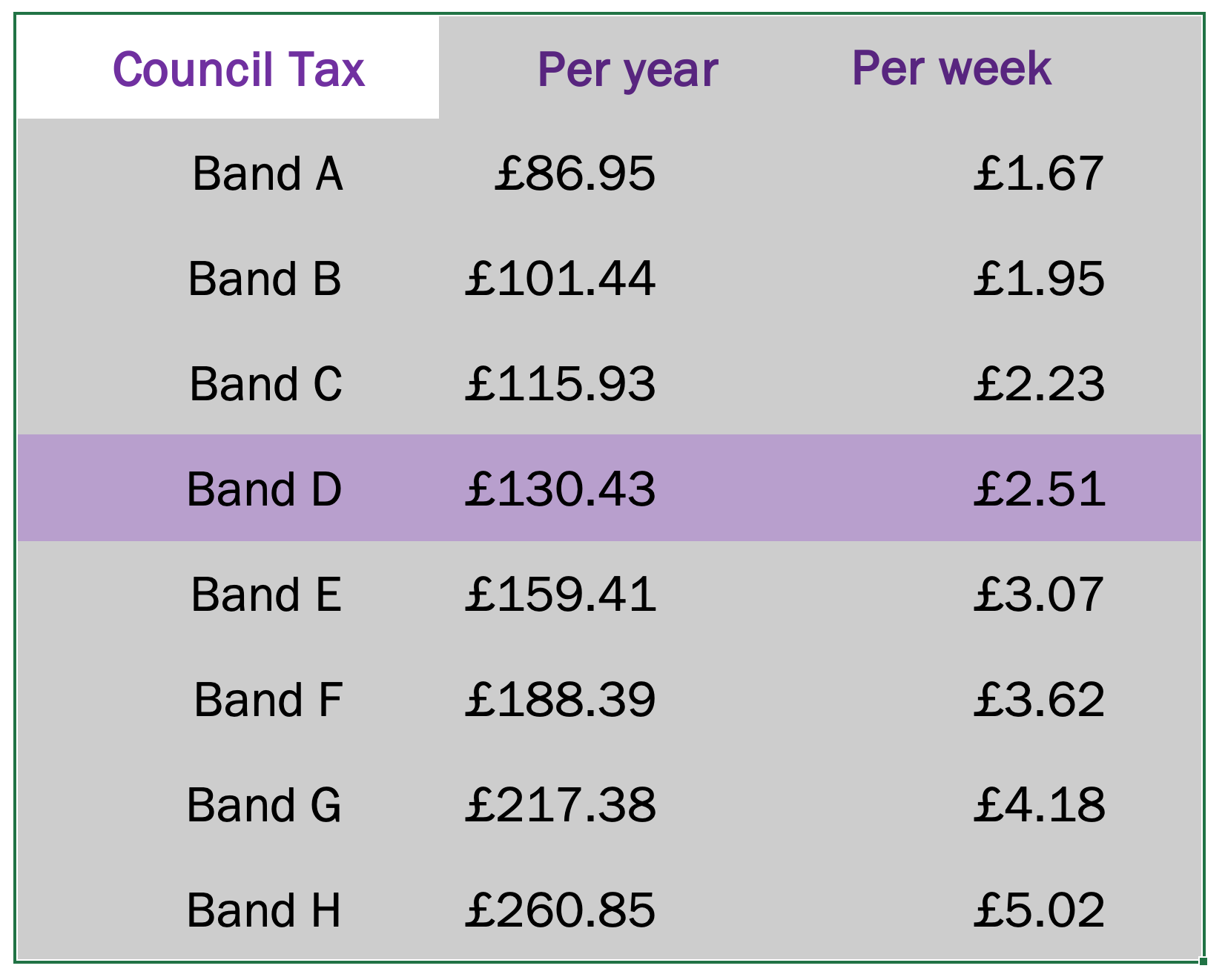

The precept income required for 2025/26 is £13,460; the Band D annual charge being £130.43 (compared with income of £12,159 in 2024/25 with a Band D annual charge of £122.94, an increase of £7.49 per year, or 6%).

The parish precept for each Council Tax band is shown below.

At each full council meeting councillors receive a detailed Finance Report, which sets out payments to be authorised and shows a bank reconciliation to the end of the previous month. Any other relevant finance-related information is also provided in these reports, which are available to download as part of the agenda and papers for the meeting.

The Parish Council's Financial Regulations set out detailed processes and control to ensure the proper use of all funds.

The Parish Clerk has also been appointed as the Council's Responsible Financial Officer.